Key Benefits of a Charitable Gift Annuity

June 25, 2025

In times of financial uncertainty, it’s natural to approach giving with caution. Many Kean University supporters have found they can make a meaningful impact while still protecting their own financial future via a charitable gift annuity (CGA) through the Kean University Foundation.

A CGA is a simple, powerful way to support Kean while securing fixed income payments for life. In exchange for your gift – made with cash or securities – you receive guaranteed payments for one or two annuitants for their lifetime(s), along with potential tax advantages. When the annuity term ends, the remaining value of your gift helps fuel Kean’s mission, supporting students, scholarships, programs and more.

Whether you’re planning ahead or seeking a stable, purpose-driven giving option today, a CGA offers peace of mind and a legacy that lasts.

Key Benefits of a Charitable Gift Annuity:

• Guaranteed fixed payments for life

• A portion of your payments may be tax-free

• Immediate charitable tax deduction

• Reduced capital gains tax when donating appreciated assets

• Lasting impact on the future of Kean University

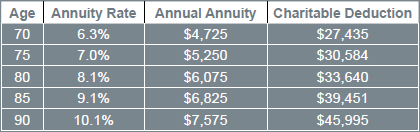

The table below shows sample rates for a gift of $75,000:

Please contact Lori Funicello, CFRE, Director of Planned Giving at the Kean University Foundation, at (908) 481-5336 or lfunicel@keanfoundation.org to learn more tax-smart ways to support the Kean University Foundation.